Why Is Bitcoin Dropping? Understanding the Recent Market Decline?

Bitcoin, the world’s leading cryptocurrency, has experienced significant price fluctuations since its inception. Many investors and enthusiasts often ask, Why is Bitcoin dropping? Understanding the factors behind its price movement is essential for both seasoned traders and new investors. Unlike traditional markets, cryptocurrency markets are influenced by a combination of macroeconomic, technical, and market sentiment factors. This article explores the main reasons why Bitcoin is dropping and provides insights into the forces shaping its current decline.

Economic and Monetary Factors

One of the primary reasons why Bitcoin is dropping is related to global economic conditions. Interest rate decisions, inflation data, and central bank policies have a direct impact on investor confidence. For example, when central banks raise interest rates to control inflation, investors often shift from riskier assets like Bitcoin to safer options such as government bonds or stable currencies. Similarly, economic uncertainty can trigger a risk-off sentiment, leading to significant sell-offs in the cryptocurrency market.

Market Sentiment and Investor Behaviour

Market sentiment plays a crucial role in Bitcoin’s price movement. Fear and uncertainty among investors often lead to panic selling, which accelerates the decline. Social media trends, news reports, and speculative behaviour can amplify market volatility. Many investors may choose to liquidate their positions to avoid further losses, creating a cycle that further contributes to why Bitcoin is dropping.

Technical Factors

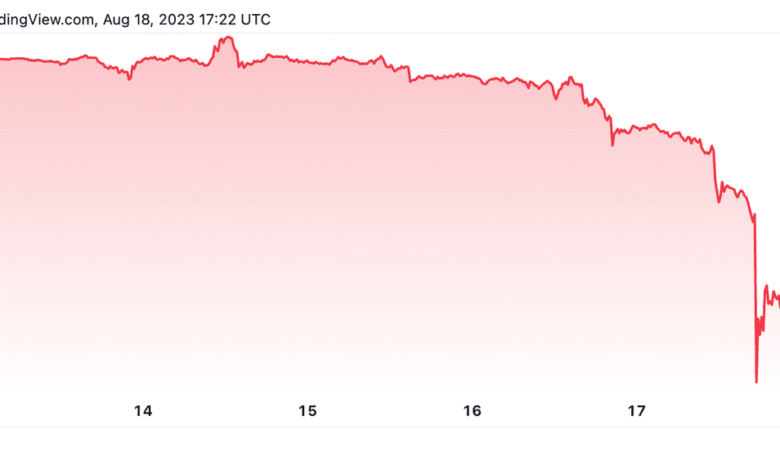

Technical analysis is another critical element in understanding why Bitcoin is dropping. Price charts, moving averages, and key support levels influence trader decisions. When Bitcoin breaks below significant support zones, stop-loss orders are triggered, causing automatic sell-offs. This technical pressure can compound the downward trend, as more traders react to the same signals, creating cascading effects on the market.

Liquidity and Leveraged Trading

The role of liquidity and leveraged trading cannot be overlooked. In cryptocurrency markets, a large portion of trading involves margin positions. When Bitcoin’s price falls, these leveraged positions are often liquidated automatically, increasing the selling pressure. High levels of leverage can therefore magnify price swings, explaining sudden drops and sharp corrections.

Institutional Influence

Institutional investors now play a significant role in the cryptocurrency ecosystem. Decisions by hedge funds, ETFs, and large-scale investors can dramatically affect Bitcoin’s market dynamics. Redemptions from institutional funds or profit-taking by large holders can contribute to why Bitcoin is dropping. Unlike retail investors, these institutions manage vast sums of capital, and their market movements can create substantial short-term price fluctuations.

Regulatory Environment

Regulatory concerns are another major factor affecting Bitcoin prices. News of potential restrictions, crackdowns, or stricter compliance requirements can cause uncertainty. Investors may preemptively sell to mitigate risk, which often triggers market-wide declines. Regulatory ambiguity, particularly in major economies, can create ongoing pressure on Bitcoin, influencing both short-term drops and long-term market sentiment.

Geopolitical Events and Global Risk

Geopolitical instability and global risk factors can also affect Bitcoin. Market reactions to conflicts, trade tensions, or macroeconomic shocks often result in broader risk aversion. Investors may shift their assets to safer instruments, causing the price of Bitcoin to drop. Global events impact liquidity and market confidence, making the cryptocurrency market more sensitive to sudden economic or political changes than traditional markets.

Mining Dynamics

Bitcoin mining also contributes to market behaviour. Mining profitability depends on electricity costs and hardware efficiency. When operational costs rise or rewards decrease, miners may sell their holdings to cover expenses. This added supply in the market can exert downward pressure on prices, explaining part of why Bitcoin is dropping during certain periods.

DeFi and Crypto Ecosystem Risks

The broader cryptocurrency ecosystem, including decentralised finance (DeFi) platforms, can affect Bitcoin’s price indirectly. Exploits, hacks, or liquidity crises in related sectors often create panic in the entire market. Even though these incidents may not directly involve Bitcoin, they impact investor confidence, resulting in sell-offs that contribute to price drops.

Technical Indicators and Market Analysis

Market analysts also track technical indicators like the Relative Strength Index (RSI), moving averages, and trading volumes to predict potential price movements. When these indicators suggest overbought conditions, traders anticipate a correction, which contributes to why Bitcoin is dropping. Similarly, low trading volumes can indicate weak market support, making price declines more pronounced during sell-offs.

Conclusion

Understanding why Bitcoin is dropping requires a holistic view of the market, combining economic, technical, institutional, and sentiment-based factors. The cryptocurrency market is highly dynamic and influenced by multiple layers of activity, from central bank policies to individual investor behaviour. By monitoring these factors, investors can better navigate market fluctuations and make informed decisions. While price drops can be concerning, they are also part of the market’s natural volatility, offering both risks and potential opportunities for informed participants.

FAQs

1. Why is Bitcoin dropping so sharply recently?

Recent drops are due to a mix of economic uncertainty, market sentiment, and technical sell-offs that have triggered cascading liquidations.

2. Does a Bitcoin drop mean the market is failing?

Not necessarily. Price declines are part of normal market cycles and often reflect short-term corrections rather than a long-term failure.

3. Can institutional investors influence the Bitcoin price?

Yes, decisions by large funds, ETFs, and whales can significantly impact short-term market dynamics, sometimes triggering rapid drops.

4. How do regulatory changes affect Bitcoin?

Announcements of stricter regulations or compliance requirements can create uncertainty, prompting investors to sell and contributing to price declines.

5. Is it safe to invest during a Bitcoin drop?

Investing during a drop carries risk but also potential opportunity. Careful research and understanding market dynamics are essential before making decisions.